Friday Insights-Tariffs, Tariffs, Paused Tariffs, and Maybe a Little Securities Fraud

April 11, 2025

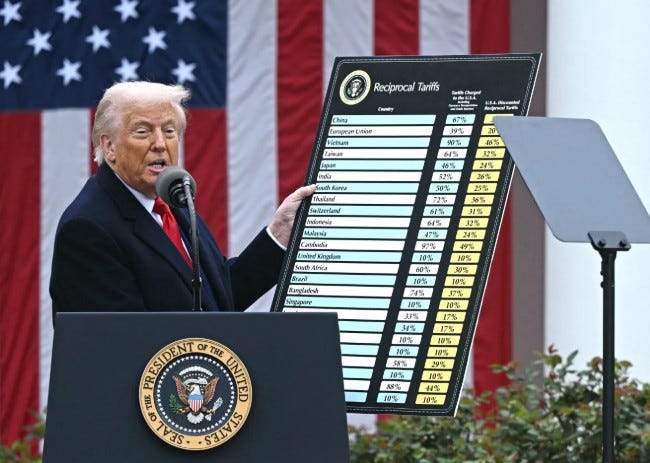

Shortly before 1:30 p.m. on Wednesday, Donald Trump announced a 90-day “pause” in most of the draconian tariffs imposed on virtually every country in the world. Russia and a handful of other countries were never included in the massive “reciprocal” tariffs, and China, the prime target of the tariffs, was not included in the pause.

Stock markets responded to the news. CNBC reports:

The S&P 500 skyrocketed 9.52% to settle at 5,456.90 for its biggest one-day gain since 2008. For the broad market index, it was the third-biggest gain in post-WWII history. The Dow Jones Industrial Average advanced 2,962.86 points, or 7.87%, to close at 40,608.45 for its biggest percentage advance since March 2020. The Nasdaq Composite jumped 12.16% to end at 17,124.97, notching its largest one-day jump since January 2001 and second-best day ever.

Prior to the announcement, markets had shed more than $11.1 trillion—yes, trillion—in market value since Inauguration Day. Thousands of stocks were trading at huge discounts compared to their prices just a few days earlier. People with money available to buy stocks just before Trump’s announcement and who knew that Trump was about to pause most of the tariffs had an opportunity to make millions.

I suspect that Trump's allies, many of whom have made their fortunes on the stock market, may be engaged in insider trading. Trump himself, who owned 114.75 million shares of Trump Media and Technology (DJT) as recently as March 25, 2025, saw his shares rise 22 percent by the time markets closed. Assuming Trump still owned the 114.75 million shares, the value of those shares rose by 22 percent, or $425,722,500.

Why do the two Senators not only suspect insider trading, but they also suspect Trump may have engaged in market manipulation? Wednesday morning, Trump posted this on Truth Social:

Was Trump tipping off his fellow DJT shareholders that the stock was about to explode in value? It looks like he was, unless you want to believe that four hours before he announced the pause in tariffs, he wasn’t even considering such a move.

Also, look closely at the language of the social media post. Trump ends his first sentence with triple exclamation marks (“!!!” before “signing” the post “DJT,” which are both the president’s initials and the stock ticker for Trump Media and Technology. Clever, wouldn’t you say? Plausible denial? Is it Trump’s fault if investors read the post and assumed he was tipping them off to buy DJT?

This whole thing stinks like rotten cheese, or, if you prefer, like Trump, if allegations that he emits nauseating smells that are best avoided by anyone sensitive to the smell of feces.

Assuming that Trump engaged in insider trading by letting a few of his buddies know of the tariff pause, or market manipulation, will he be held accountable? I wouldn’t count on it.

Read the Schiff-Gallego letter here.

And the tariffs themselves.

I won’t repeat the news here because you already know the U.S. has started a trade war with China and the rest of the world. The world may suffer a Trump-induced economic crisis.

The trade war continues despite Wednesday’s 90-day pause in tariffs on most countries. It will continue until then because trade deals take time—some estimate years rather than months. The uncertainty during the 90-day pause will continue to shake the world economy. Of course, Trump may change his mind and reinstate the tariffs at any time, for example, if he gets mad at someone or the world.

Trump is mad at China. According to the White House, the tariff rate on most Chinese-made goods imported into the U.S. is 145 percent.

Earlier this week, Elon Musk called Trump trade advisor Peter Navarro “a moron,” and suggested he is as “dumb as a brick.” I have finally found something Musk has said since January 20th that I agree with.

I am not an economist, but I shudder as I see Trump continue to suggest that tariffs will produce an economic boom. Why do so many economists disagree?

Polls show Trump headed south in popularity.

While Fox News anchors and hard-core MAGAites continue to praise Trump’s tariffs, the public is souring on Trump. His approval ratings are sinking, fast.

Once the public starts directly experiencing price increases—they are already starting on some products—Trump’s popularity will continue to decline. That is a good thing.

The lower Trump sinks in the polls, the more likely Republican legislators will stop blindly following him. That can’t happen too soon.

Trump tax cuts heading for enactment and permanence.

As widely reported, the House passed a budget resolution 216-214 with only two Republicans voting “no.” The resolution assumes the extension of the Trump tax cuts and makes them “permanent,” meaning that, unlike their 2017 predecessor, they will have no expiration date. The bill also supports other parts of the Trump agenda, including ending taxes on tips and making the interest on car loans deductible if the car being purchased is American-made. The reconciliation bill is commonly called the “Big Beautiful Bill.”

Nothing is beautiful about the bill unless you are a billionaire anxious for lower taxes. The bill will pass later this Spring, and income inequality is about to increase.

On that positive note, that’s it for today.

Thank you.

Thank you for reading today’s Friday Insights. I appreciate it.